Double jeopardy?

Students of finance postulate that there is ALWAYS an inverse relationship between interest rates and stock market performance. They must be very confused about the current trends where both market performances are facing south. However, the comfort for them is that in the Finance dictionary, there also exists the word CORRECTION. As to which market is correcting, that’s your call.

Bullish Thoughts wonders just how many issued shares are out there for most blue chips (or alleged blue chips). One would have thought that with a share register dominated by institutional shareholders and a deliberate move away from penny stocks and some mid tiers, the share prices would be stable and upward moving. But there is just an overhang that no one seems to be able to explain. Surely only stocks with a billion plus shares in issue would have that kind of price and volume behavior.

Were the 19 February 2009 share prices incorrect?

Still on the stock market, do your spreadsheet modeling, some technical analysis or basic maths to check where share prices are right now compared to where they were on February 19, 2009. Bullish Thoughts is slowly getting convinced that those share price largely reflected the truth, no matter our belief (then and now) to the contrary? On aggregate, industrials are up just 28% and Mining 50% on the February 19, 2009 prices(as of Friday 18 June 2010)!

From the financial wilderness to influencing the future

Scholars of the Old Testament are familiar with how God helped Moses lead the Israelites from Egyptian captivity in the famous EXODUS, preceded by the infamous 10 plagues. Closer home, and in the A.D. space, former Premier Finance Group CEO, Exodus Makumbe seems set to lead his small team to influence the future. His financial outfit, Platinum Groupe (formerly Exodus & Co.) has been snapping up some financial firms on the market. It started with NDH Equities (now Platinum Stockbrokers) and has added an asset management outfit through the acquisition of MBCA Capital Management from the right sizing Nedbank linked group. They were wise enough to skirt the NDH banking business though. We wait to see how else they seek to influence the Zimbabwean financial future! Bullish Thoughts hopes it won’t take 40 years of wondering in the financial desert before reaching the promised financial BOTTOMLINE.

Golden leaf outperforms the White Gold

The tobacco farmers have been the talk of town for some time; outside putchases of DSTV decoders on full year subscriptions, Plasma and LCD TVs, G-Tide phones among others has made farming the in-thing! But certainly not for cotton farmers. The purveyors of the formerly “white gold” have been trying hard to have firm prices paid to the poor cotton farmers. The price issue is set to be heard in Cabinet. High profile indeed. However, Bullish Thoughts would like to highlight that the world over, farmers are hugely subsidized. Back to Zimbabwe, now that we no longer have ASPEF, BACOSSI, Operation Maguta, Operation etc etc, Treasury simply doesn’t have the money to subsidise farmers. The central bank itself is literally under judicial management. So the cotton farmers should know that if they can’t process their own stuff for direct marketing at $0.90/kg they are fond of talking about, they should just forget the plushy and flashy lifestyles of smoke pummeling cigar(ette) tobacco farmers.

Buffett's $2.63 Million Lunch Tab

In case you noticed a suspicious lack of Buffett in this week's financial news, let's remedy that. Buffett's annual lunch auction, which closed at 10:30 on Friday night, reached $2.63 million. The winner and seven friends get to have a steak lunch with the Oracle. The proceeds from this auction go to the Glide Foundation in San Francisco. And for the purchasers of one of the most expensive lunches in history, let's hope that Buffett imparts two and a half million dollars worth of wisdom!

ZAR benefits from positives out of Eurozone?

A weaker Euro was great news for Zimbabwean businesses given that close to 90% of the the transactions are US$ based. With a strong positive correlation (ρ>0.5) on the €/ZAR, the Rand staged a break out on the ZAR8.0000 mark when the Euro fell to €1.19 against the US$. Treasury strategy would have been to buy as many rands as possible even for currency trading purposes. We wrote on 23 May that the weaker Rand (then at ZAR8.019) represented an easy money opportunity even to layman. We hope you cashed in.

Now that the days of fiery riots in Greece are over, with lawmakers and politicians still working out a plan for how to put the Eurozone back on its feet, the opportunity has disappeared. Greece revealed that it had managed to cut its national budget in the first five months of the year, and that its revenue was up 8%. One of the other worrisome European countries, Portugal, announced that its economy had been expanding so far in 2010. The eurozone rescue package was also completed this past week, with the eurozone finance ministers approving a $520 billion bailout. As of Friday evening, the rand was at ZAR7.5 following recovery of the Euro to €1.23861 again making it expensive for Zimbabwean importers. With the country importing more than ever as local manufacturers fail to raise the bar I terms of quality and price, the possibility of a strong knock on inflationary effect is higher.

BP Gets Punished

Most people probably didn't expect this BP (NYSE:BP) incident to go on for six weeks, but it has. Now that marine wildlife, the environment as a whole, the residents of Florida, Alabama, Louisiana, and many others have suffered, BP is getting hammered.

Bullish Thoughts remembers arguing with Paul Richards (a former investment banker at UBS, HSBC, Map Securities & ex CEO of Credit Industriel et Commercial) late May 2010 that the BP Deep Water Horizon Rig explosion would be the biggest ever environment disaster and would destroy shareholder value. He opined that, that was a dot in BP’s life given the company’s size and revenues hence there was no need to sell BP shares then. We are pretty sure that after the BP Board decided to skip a dividend and set up a $20bn clean up & compensation fund, the 40% dip in the shre price is surely shareholder value destruction. To make it worse, CEO Tony Hayward angered the Congress panel on the oil disaster and Americans will be looking at annihilating this British MNC.

ZESA Malice

The GNU government should investigate ZESA. Someone at ZESA is bent on causing anarchy and despondency by creating mayhem in the country. How does ZESA explain the fact that electricity is always switched off with 5-15 minutes remaining in a World Cup Match when an African Team is playing only to be restored about 3 minutes after the end of stoppage time. That is certainly criminal and unpatriotic and has nothing to do with power generation challenges! Why are we forced to support only teams supported by ZESA(less) employees? Sokwanele!

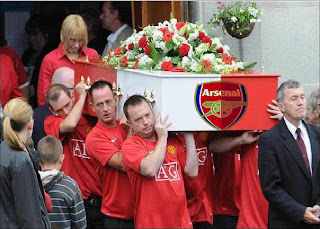

Full Arsenal

Looking up the word Arsenal in the MS Word Dictionary revealed it can loosely mean these words: weapon store, munitions store, armoury, magazines, or just store. Bullish Thoughts is pretty sure that if Arsene Wenger does not start to effectively use the contents of his soccer goals munitions store, scenes such as the one below will be very common in the new season just around the corner especially the opener against Loserpool!

Log onto your investment website www.bulls.co.zw for an update of local, regional & global financial business updates. Current ZSE Prices are available from the site. You can also view ZSE Single Callover with a delay of only 5 minutes. Follow Bullish Thoughts on http://bullishthoughts.blogspot.com and let’s have exciting debate on any business/ investment topics you wish to suggest.

BULLISH THOUGHTS. We are bullish!

No comments:

Post a Comment